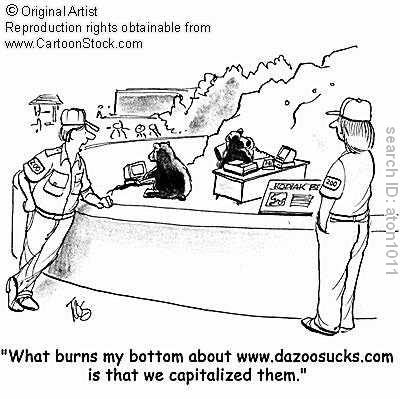

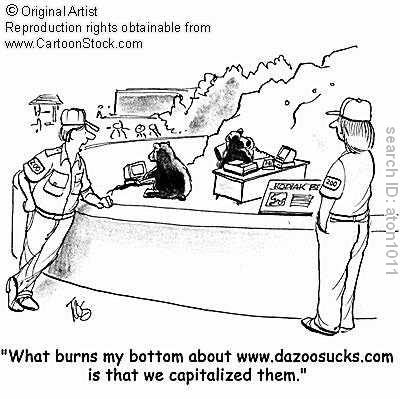

An executive says to his VC partner in the above cartoon, "What burns my bottom about www.dazoosucks.com is that we capitalized them."

An executive says to his VC partner in the above cartoon, "What burns my bottom about www.dazoosucks.com is that we capitalized them."

Monday, October 26, 2009

We capitalized them...

An executive says to his VC partner in the above cartoon, "What burns my bottom about www.dazoosucks.com is that we capitalized them."

An executive says to his VC partner in the above cartoon, "What burns my bottom about www.dazoosucks.com is that we capitalized them."

Sunday, October 25, 2009

Screening due diligence #5: Quality of accounting firm?

Who is the company's accounting firm?

Early stage companies also need quality accounting advice and assistance to function and grow effectively. This generally involves three basic services. First, the law requires all companies to file tax returns, and accounting firms can certainly aid in that area. And, outsourcing tax preparation often makes a lot of sense for young companies because it allows them to focus on their real task: building their companies. Second, many early-stage companies can benefit significantly from assistance with bookkeeping. Indeed, a well-designed book-keeping system is crucial to effective early-stage management. And, third, early-stage companies will, at some point, require auditing services. Auditing services can facilitate further venture financing, bank financing, and financing in the public markets, and can often aid in forging customer relationships.

Furthermore, like their legal counterparts, venture-oriented accounting firms offer services beyond traditional accounting type services. As Jeffry A Timmons, professor at the Harvard Business School, points out:

Accountants who are experienced as advisors to emerging companies can provide, in addition to audit and taxation, other valuable services. An experienced general business advisor can be invaluable in helping to think through strategy, in helping to find a right VC.

Early stage companies also need quality accounting advice and assistance to function and grow effectively. This generally involves three basic services. First, the law requires all companies to file tax returns, and accounting firms can certainly aid in that area. And, outsourcing tax preparation often makes a lot of sense for young companies because it allows them to focus on their real task: building their companies. Second, many early-stage companies can benefit significantly from assistance with bookkeeping. Indeed, a well-designed book-keeping system is crucial to effective early-stage management. And, third, early-stage companies will, at some point, require auditing services. Auditing services can facilitate further venture financing, bank financing, and financing in the public markets, and can often aid in forging customer relationships.

Furthermore, like their legal counterparts, venture-oriented accounting firms offer services beyond traditional accounting type services. As Jeffry A Timmons, professor at the Harvard Business School, points out:

Accountants who are experienced as advisors to emerging companies can provide, in addition to audit and taxation, other valuable services. An experienced general business advisor can be invaluable in helping to think through strategy, in helping to find a right VC.

Saturday, October 24, 2009

Screening due diligence #4: Quality of Legal Counsel

Who is the company's legal counsel?

To be successful, early-stage companies need good legal counsel. The road from start-up through high growth to successful maturity is much too hazardous to forge ahead without a high-quality and appropriately experienced law firm on board. On one hand, law firms provide vital legal services such as creating corporate structure, addressing employment issues, and advising on contract negotiations. Companies receiving sound, quality legal advice in these areas certainly increase their likelihood of success. Regarding contracts, the venture capitalists at Accel Partners state that the "corporate contracts demanded of new companies grow geometrically - distribution agreements, employment agreements, financial agreements, patent agreements - and mistakes on any of them can seriously jeopardize a company's ultimate value. Even minor errors can require inordinate top management attention." On the other hand, law firms also often provide other services to early-stage companies, such as giving advice on business plan construction and financing strategy, and making introductions to venture capital firms, bankers, accounting firms, and consultants. Receiving this assistance from experienced and well connected lawyers can also boost a company's likelihood of success. Therefore, a fourth screening mechanism sometimes used by some venture capitalists is to evaluate the quality of companies' legal counsel.

Determining the quality of law firms is not always easy for venture investors, but, as Christopher Schaelpe, general partner of Weiss, Peck & Greer Venture Partners, explains, there are only "on the order of 15 major law firms throughout the country with a core competence in advising private high-technology companies'. In Silicon Valley, this fraternity includes Wilson Sonsini Goodrich & Rosati; the Venture Law Group; Cooley Godward; Gunderson Detmer; Fenwick & West; Brobeck Phleger & Harrison; Heller Ehrman White & McAuliffe; and Gray Cary Ware & Freidenrich. In Boston, it includes Hale & Dorr; Testa Hurwitz & Thibeault; and Edwards & Angell. In New York, it includes Skadden Arps Slate Meagher & Flom; O'Sullivan Graev & Karabell; Reboul MacMurray Hewit Maynard & Kristol. In Seattle, it includes Perkins Coie.

To be successful, early-stage companies need good legal counsel. The road from start-up through high growth to successful maturity is much too hazardous to forge ahead without a high-quality and appropriately experienced law firm on board. On one hand, law firms provide vital legal services such as creating corporate structure, addressing employment issues, and advising on contract negotiations. Companies receiving sound, quality legal advice in these areas certainly increase their likelihood of success. Regarding contracts, the venture capitalists at Accel Partners state that the "corporate contracts demanded of new companies grow geometrically - distribution agreements, employment agreements, financial agreements, patent agreements - and mistakes on any of them can seriously jeopardize a company's ultimate value. Even minor errors can require inordinate top management attention." On the other hand, law firms also often provide other services to early-stage companies, such as giving advice on business plan construction and financing strategy, and making introductions to venture capital firms, bankers, accounting firms, and consultants. Receiving this assistance from experienced and well connected lawyers can also boost a company's likelihood of success. Therefore, a fourth screening mechanism sometimes used by some venture capitalists is to evaluate the quality of companies' legal counsel.

Determining the quality of law firms is not always easy for venture investors, but, as Christopher Schaelpe, general partner of Weiss, Peck & Greer Venture Partners, explains, there are only "on the order of 15 major law firms throughout the country with a core competence in advising private high-technology companies'. In Silicon Valley, this fraternity includes Wilson Sonsini Goodrich & Rosati; the Venture Law Group; Cooley Godward; Gunderson Detmer; Fenwick & West; Brobeck Phleger & Harrison; Heller Ehrman White & McAuliffe; and Gray Cary Ware & Freidenrich. In Boston, it includes Hale & Dorr; Testa Hurwitz & Thibeault; and Edwards & Angell. In New York, it includes Skadden Arps Slate Meagher & Flom; O'Sullivan Graev & Karabell; Reboul MacMurray Hewit Maynard & Kristol. In Seattle, it includes Perkins Coie.

Friday, October 23, 2009

Screening due diligence #3: Quality of Other Equity Investors

Who are the company's existing investors, and who are the potential co-investors?

Venture capitalists also often focus on the quality of companies' existing equity investors and potential current round coinvestors as a third screening mechanism. They do this for two reasons. First, an impressive investor list is often indicative of a good investment. Simply put, great companies attract high-quality investors. Conversely, a company's inability to find any high-quality investors suggests that an investment may not be a very promising one. Second, high-quality investors often contribute significantly to their companies' success. Depending on the particular investors, they may provide any or all of the following to their portfolio companies: general business knowledge, operating experience, and business reputation. Equity investors may also bring to their portfolio companies extended networks of contacts to mangement recruits, service providers (law firms, accounting firms, public relation firms, etc.) customers, suppliers, strategic partners, venture capitalists, potential acquirers, and/or investment bankers.

A somewhat related point that some venture capitalists examine during due diligence is whether, and to what extent, existing equity investors will participate in the current round of financing. The failure of existing investors to support the company may dramatically reduce interest on the part of venture capitalists because existing investors often have unique information about the companies in which they hold equity. Almost surely, they have more high-quality information than that available to potential investors, even after thorough due diligence. Accordingly, if existing investors choose not to participate fully in subsequent rounds, it may quite possibly be the result of problems not visible to potential investors.

Venture capitalists also often focus on the quality of companies' existing equity investors and potential current round coinvestors as a third screening mechanism. They do this for two reasons. First, an impressive investor list is often indicative of a good investment. Simply put, great companies attract high-quality investors. Conversely, a company's inability to find any high-quality investors suggests that an investment may not be a very promising one. Second, high-quality investors often contribute significantly to their companies' success. Depending on the particular investors, they may provide any or all of the following to their portfolio companies: general business knowledge, operating experience, and business reputation. Equity investors may also bring to their portfolio companies extended networks of contacts to mangement recruits, service providers (law firms, accounting firms, public relation firms, etc.) customers, suppliers, strategic partners, venture capitalists, potential acquirers, and/or investment bankers.

A somewhat related point that some venture capitalists examine during due diligence is whether, and to what extent, existing equity investors will participate in the current round of financing. The failure of existing investors to support the company may dramatically reduce interest on the part of venture capitalists because existing investors often have unique information about the companies in which they hold equity. Almost surely, they have more high-quality information than that available to potential investors, even after thorough due diligence. Accordingly, if existing investors choose not to participate fully in subsequent rounds, it may quite possibly be the result of problems not visible to potential investors.

Thursday, October 22, 2009

Screening due diligence #2: Quality of the Business Plan

What is the overall quality of the company's business plan?

As a second screening mechanism, venture capitalists often scrutinize the business plans they receive to gauge the quality of general presentations, thoroughness, clarity, coherence, and focus. These surface aspects often convey much about the quality of the investment opportunities and the entrepreneurs, themselves, underlying the surface. Says Russ Siegelman, partner at Kleiner Perkins Caufield & Byers:

The variations in the quality of the plans I read is amazing. Sometimes they look like the entrepreneur's dog has chewed them, and they are photocopied sloppily onto standard copy paper, with typos & coffee stains. Sometimes they are glossy, well written, with plenty of Excel generated charts and pages of financial projections. One might think that a good VC will get beyond the stains and the chewed pages and get to the business idea to make a judgement. But that isn't my view. If entrepreneurs don't present their ideas in a quality way, they probably aren't organized or professional enough for me to want to invest. I am not typically a form over substance kind of guy, but when it comes to business plans, I can't get to the substance if the form doesn't make the quality bar.

C Gordon Bell, Digital Equipment Corporation veteran and adviser to US Venture Partners, states rightly that 'the ability of a CEO and his or her top-level group to write a good business plan is the first test of their ability to function as a team and to run their proposed company successfully.'

At a minimum, venture capitalists prefer business plans that convey a coherent and compelling story. They like plans that are clear, concise, thorough, and professional in presentation; practical, realistic, and credible in content; and that adequately explain all assumptions on which claims are made. They also like highly focused, concise plans. Venture capitalists generally prefer business plans that present a lot of information in a very few words.

Plans addressing these topics fully (but efficiently) tend to be effective in conveying to venture capitalists the overall merits of the given investment opportunities. They also provide a solid foundation on which venture capitalists can begin their due diligence.

Additionally, most venture capital investors strongly favor business plans that contain well-thought-out, well-defined milestones. Venture capitalists use such milestones to measure and monitor companies' performance. Alan E Salzman, managing partner of VantagePoint Venture Partners, and John Doerr explain, for venture capitalists, 'early detection of deviation from the plan will indicate needed changes in the scheduled financings and help identify emerging problems in time for corrective action.' Business plans containing appropriate and well-defined milestones facilitate this function.

As a second screening mechanism, venture capitalists often scrutinize the business plans they receive to gauge the quality of general presentations, thoroughness, clarity, coherence, and focus. These surface aspects often convey much about the quality of the investment opportunities and the entrepreneurs, themselves, underlying the surface. Says Russ Siegelman, partner at Kleiner Perkins Caufield & Byers:

The variations in the quality of the plans I read is amazing. Sometimes they look like the entrepreneur's dog has chewed them, and they are photocopied sloppily onto standard copy paper, with typos & coffee stains. Sometimes they are glossy, well written, with plenty of Excel generated charts and pages of financial projections. One might think that a good VC will get beyond the stains and the chewed pages and get to the business idea to make a judgement. But that isn't my view. If entrepreneurs don't present their ideas in a quality way, they probably aren't organized or professional enough for me to want to invest. I am not typically a form over substance kind of guy, but when it comes to business plans, I can't get to the substance if the form doesn't make the quality bar.

C Gordon Bell, Digital Equipment Corporation veteran and adviser to US Venture Partners, states rightly that 'the ability of a CEO and his or her top-level group to write a good business plan is the first test of their ability to function as a team and to run their proposed company successfully.'

At a minimum, venture capitalists prefer business plans that convey a coherent and compelling story. They like plans that are clear, concise, thorough, and professional in presentation; practical, realistic, and credible in content; and that adequately explain all assumptions on which claims are made. They also like highly focused, concise plans. Venture capitalists generally prefer business plans that present a lot of information in a very few words.

Plans addressing these topics fully (but efficiently) tend to be effective in conveying to venture capitalists the overall merits of the given investment opportunities. They also provide a solid foundation on which venture capitalists can begin their due diligence.

Additionally, most venture capital investors strongly favor business plans that contain well-thought-out, well-defined milestones. Venture capitalists use such milestones to measure and monitor companies' performance. Alan E Salzman, managing partner of VantagePoint Venture Partners, and John Doerr explain, for venture capitalists, 'early detection of deviation from the plan will indicate needed changes in the scheduled financings and help identify emerging problems in time for corrective action.' Business plans containing appropriate and well-defined milestones facilitate this function.

Tuesday, October 20, 2009

Screening due diligence #1: Quality of Source

From what source did the deal come or by whom was the deal referred?

A simple and effective screening mechanism used by many venture capitalists is to scrutinize the routes from which deals emerge. Venture capitalists overwhelmingly tend to favor deals referred to them by trusted sources. Kevin Fong, general partner of the Mayfield Fund, states that his firm relies consistently and heavily on its network of lawyers, portfolio companies, and other respected contacts to uncover the best deals. According to John Doerr, general partner of Kleiner Perkins Caufield & Byers, of the over 250 ventures in which his firm has invested, almost everyone was referred by a trusted source: 'a CEO, an engineer, a lawyer, friend, or another venture capitalist - known to both the founders and [the] partnership.' The reason that venture capitalists take this approach is that they usually know much more about the quality of the source by which a deal was referred than about the quality of the referred deal itself. It makes sense, then, for them to use the quality of the source of the deal, which is well known, as a rough proxy for the quality of the deal, which is not.

A simple and effective screening mechanism used by many venture capitalists is to scrutinize the routes from which deals emerge. Venture capitalists overwhelmingly tend to favor deals referred to them by trusted sources. Kevin Fong, general partner of the Mayfield Fund, states that his firm relies consistently and heavily on its network of lawyers, portfolio companies, and other respected contacts to uncover the best deals. According to John Doerr, general partner of Kleiner Perkins Caufield & Byers, of the over 250 ventures in which his firm has invested, almost everyone was referred by a trusted source: 'a CEO, an engineer, a lawyer, friend, or another venture capitalist - known to both the founders and [the] partnership.' The reason that venture capitalists take this approach is that they usually know much more about the quality of the source by which a deal was referred than about the quality of the referred deal itself. It makes sense, then, for them to use the quality of the source of the deal, which is well known, as a rough proxy for the quality of the deal, which is not.

Friday, October 16, 2009

Developing a map of possible stepping stones

Given the way in which business plans are prepared and written, they almost inevitably set out the future development of the business in a linear fashion. The earlier approach of thinking in terms of stepping stones seems to reinforce this. This linearity does not do the entrepreneur justice.

No business is linear. It is a living entity full of possibilities and dangers. There are many possible destinations and many possible sequences of stepping stones for getting to each destination. The prize being sought by Creditica in Q2 2008 might not end up being the prize attained in 2012 and beyond.

If there were only one way for Creditica to pursue its business plan, investors would be concerned. Every entrepreneurial business goes through a series of existential crises. The best-laid plans often don't survive the first contact with customers or competitors. Executing strategies in the real world takes longer than it does on paper. It is extremely difficult to predict the future for a business five to seven years down the road. If the path being pursued terminates (eg, because of the emergence of a dominant competitor), the business could die.

What is needed is a map of possible stepping-stones rather than a deterministic single path. A good map will excite an investor much more than a path. A map should communicate options and possibilities. As any financial theorist will tell you, options have value. All investors usually ask themselves the following questions:

If there are a few big potential roadblocks ahead - even if there is only a small chance of them happening - investors will want to see a plan B. In fact, they will want to know that there are many plan Bs.

An investor might look at Creditica and see the following potential roadblocks (no doubt you will see others):

No business is linear. It is a living entity full of possibilities and dangers. There are many possible destinations and many possible sequences of stepping stones for getting to each destination. The prize being sought by Creditica in Q2 2008 might not end up being the prize attained in 2012 and beyond.

If there were only one way for Creditica to pursue its business plan, investors would be concerned. Every entrepreneurial business goes through a series of existential crises. The best-laid plans often don't survive the first contact with customers or competitors. Executing strategies in the real world takes longer than it does on paper. It is extremely difficult to predict the future for a business five to seven years down the road. If the path being pursued terminates (eg, because of the emergence of a dominant competitor), the business could die.

What is needed is a map of possible stepping-stones rather than a deterministic single path. A good map will excite an investor much more than a path. A map should communicate options and possibilities. As any financial theorist will tell you, options have value. All investors usually ask themselves the following questions:

- What are the big things that could go wrong (and how will the business handle them)?

- What are the big options that might open up further down the road (and how might the business take advantage of them)?

If there are a few big potential roadblocks ahead - even if there is only a small chance of them happening - investors will want to see a plan B. In fact, they will want to know that there are many plan Bs.

An investor might look at Creditica and see the following potential roadblocks (no doubt you will see others):

- Credit card issuers might view their proprietary algorithms as so fundamental to their competitive advantage that they will not utilize 3rd-party algorithms from a company such as Creditica.

- Creditica's algorithms are a black-box giving out results (target customer names). The results, although accurate, are hard to rationalize simply. Therefore, the results might not be trusted.

- New personal privacy legislation might prohibit sharing of data from one company to another.

- The bank from which the team originated might change its mind and attempt to block the business.

Thursday, October 15, 2009

What venture capitalists (VCs) typically look for?

As an example of what venture capitalists typically look for in business plan topic coverage, the partners at CMGI @Ventures like business plans to include the following eight categories of information:

- The Business:

Company's business.

Strategy.

Mission statement. - The Market:

Historic and projected sizes in dollars.

Market trends. - Product offering:

Product description.

Development schedule & launch date(s).

Product differentiation.

Revenue model. - Distribution:

Key customers.

Customer acquisition strategy.

Sales channels.

Partnerships. - Competition:

Key competitors.

Competitive advantages.

Barrier to entry. - Management Team:

Roles & responsibilities.

Background of team members.

Board composition - Financials:

Historic and forecasted P&L (first two years by quarters).

Projected cash flow (first two years by quarters).

Current balance sheet.

Projected head count by functional area (G&A, sales, marketing, product development).

Capitalization schedule. - The deal:

Amount to be raised.

Anticipated valuation.

Use of proceeds.

Wednesday, October 14, 2009

Tuesday, October 13, 2009

Matching the Financing Strategy to the Stepping Stones

The Stepping Stones should then seamlessly match the financing strategy for the business.

The Stepping Stones should then seamlessly match the financing strategy for the business.Consider the example of Creditica in the above figure. If the team has established a workable set of stepping-stones and if the company executes the plan well, it will raise four rounds of investment in the course of its development. In the VC business these are called Series A, B, C and D and so forth.

Many software companies before Creditica have proven that moving from stepping-stone to stepping-stone, while continuing to convince investors of the size of the ultimate prize, is a good financing strategy for a company.

The Series A round should be big enough to get the company to stepping stone 1 (with some margin of error since plans generally take longer to execute than expected). In theory, from start-up, the company could consider raising enough money to take itself to stepping-stone 2 or beyond - if it can find a willing investor. But this misses the point. At start-up the company will probably be at the lowest valuation of its existence. Therefore, if it raised the capital to get it all the way to stepping-stone 2 or beyond, the initial shareholders would suffer far more dilution in their ownership percentages than is necessary. Better to raise just enough capital now and raise more later at a higher valuation.

This is the essence of the early-stage venture game - raising just enough to get to the next stage of development of the company (with a reasonable margin of error) in the hope and expectation of raising more capital on much more attractive terms later.

To get started, the entrepreneur needs to convince the investors of three propositions:

- The ultimate prize is worth going for. (The opportunity is big enough for early investors to get a 10 to 20 times multiple return on their investment.)

- There are logical, achievable stepping-stones between start-up and the prize. (There are future points in the development of the company where new investors can be enticed to come on board and where the risks of the business have been progressively stripped away.)

- The first stepping-stone on the way to the prize, by itself, is a stepping-stone worthy of investment by the investor. (A second-round investor will pay a price per share two to four times the price the early investor paid.)

Monday, October 12, 2009

Friday, October 9, 2009

Creating a set of stepping-stones for a new business

The founders of Creditica have set out a 4 to 5 year high level plan for their business. They expect the business to achieve its potential within this period. They expect the business to achieve its potential within this period. What they have also done implicitly in the plan (even though they might not have intentionally done so) is to split the journey into 3 or 4 major stepping stones. The figure shows the implied steps from the establishment of the business in early 2008 to the possible exit of the business in 2012 or later.

The founders of Creditica have set out a 4 to 5 year high level plan for their business. They expect the business to achieve its potential within this period. They expect the business to achieve its potential within this period. What they have also done implicitly in the plan (even though they might not have intentionally done so) is to split the journey into 3 or 4 major stepping stones. The figure shows the implied steps from the establishment of the business in early 2008 to the possible exit of the business in 2012 or later.Creditica's is a straightforward path of stepping-stones. It is a classic software company path seen by venture capitalists in hundreds, if not thousands, of business plans every year. It has proven itself over the years. Many companies have followed such a path and built valuable businesses. Of course, many have also failed.

Stepping-stones represent groups of major milestones for the company. The milestones might relate to product development, acquisition of customers, recruitment or top-class management, and so forth. The groups of milestones then become stepping-stones. Each stepping-stone provides an integrated perspective on the progress (and potential valuation) of the company.

The best stepping-stones are ones that the company can point to with hard evidence and that demonstrates real momentum in the progress of the business. It is the team's task to articulate the major stepping-stones because it is impossible for an investor to absorb all of the micro steps a company will take in the course of its development.

Thursday, October 8, 2009

Wednesday, October 7, 2009

Venture Capital Due Diligence by Justin J. Camp

Venture Capital Due Diligence is a guide to making smart investment choices and increasing your portfolio returns by Justin J Camp. Venture Capital Due Diligence provides a clear & complete explanation of the VC due diligence process & shows you how to use it to assess investment opportunities, make smart investment decisions and increase the return on your overall venture capital portfolio.

Venture Capital Due Diligence is a guide to making smart investment choices and increasing your portfolio returns by Justin J Camp. Venture Capital Due Diligence provides a clear & complete explanation of the VC due diligence process & shows you how to use it to assess investment opportunities, make smart investment decisions and increase the return on your overall venture capital portfolio.This comprehensive guide offers a full explanation of the venture capital due diligence process, from using screening mechanisms that sort out potential opportunities, to assessing the management qualities, business models, legal issues, and even intangibles of target companies. Structured around a number of carefully crafted questions that venture capitalists often ask when performing due diligence, this book puts you in the position of a VC conducting due diligence on a particular company.

In-depth discussions of these questions and their possible answers pull together opinions from many of the major players in today's venture capital industry, including...

- Richard Testa of Testa Hurwitz & Thibeault

- Ann Winblad of Hummer Winblad Venture Partners

- John Doerr of Kleiner Perkins Caufield & Byers

- Craig Johnson of the Venture Law Group

- Don Valentine of Sequoia Capital

- Keving Fong of the Mayfield Fund

An essential guide for anyone involved in venture capital investing, Venture Capital Due Diligence helps you uncover potential problems, while showing you where to look and what to look for when conducting VC due diligence.

Tuesday, October 6, 2009

Cartoon: Venture capital for a clown

Saturday, October 3, 2009

More venture capital organizations in USA & world

Young Venture Capital Organizations

- New England Venture Network

- New York Private Equity Network

- Young Venture Capital Association

- Young Venture Capital Society

- African Venture Capital Association

- Australian Private Equity and Venture Capital Association

- Belgian Venturing Association

- Brazilian Private Equity and Venture Capital Association

- British Venture Capital Association

- Canada’s Private Equity and Venture Capital Association

- China Venture Capital Association

- Czech Venture Capital and Private Equity Association

- European Venture Capital Association

- Finnish Venture Capital Association

- Association Francaise des Investisseurs en Capital

- German Private Equity and Venture Capital Association

- Gulf Venture Capital Association

- Hong Kong Venture Capital & Private Equity Association

- Hungarian Venture Capital Association

- Indian Venture Capital Association

- Irish Venture Capital Association

- Israel Venture Association

- Italian Private Equity and Venture Capital Association

- Japan Venture Capital Association

- Latin American Venture Capital Association

- Netherlands Venture Capital Association

- Russian Private Equity & Venture Capital Association

- Singapore Venture Capital and Private Equity Association

- Spanish Venture Capital Association

- Swedish Venture Capital Association

- Swiss Private Equity & Corporate Finance Association

- Thai Venture Capital Association

Friday, October 2, 2009

Thursday, October 1, 2009

Fundamentals of Venture Capital by Joseph W. Bartlett

The hardcover edition of the book Fundamentals of Venture Capital by Joseph W. Bartlett imparts you knowledge about what a venture capital is, how do they talk and who should start their own company. The book answers to your questions like Where should I look for seed capital, How on Earth do I put a value on my company, what legal forms would work best for me and what will my corporation look like? The book will also help you to draft the business plan and the placement memo. Philip E McCarthy, venture capitalist in residence, Wharton School of Business and managing partner MBW Management Inc says this about the book, "Joseph W Bartlett, long recognized as one of the very top lawyers in the Venture Capital/Private Investing field, has reached the right balance between concept, practical advice and insights in the field. Hard hitting, no nonsense".

The hardcover edition of the book Fundamentals of Venture Capital by Joseph W. Bartlett imparts you knowledge about what a venture capital is, how do they talk and who should start their own company. The book answers to your questions like Where should I look for seed capital, How on Earth do I put a value on my company, what legal forms would work best for me and what will my corporation look like? The book will also help you to draft the business plan and the placement memo. Philip E McCarthy, venture capitalist in residence, Wharton School of Business and managing partner MBW Management Inc says this about the book, "Joseph W Bartlett, long recognized as one of the very top lawyers in the Venture Capital/Private Investing field, has reached the right balance between concept, practical advice and insights in the field. Hard hitting, no nonsense".

Wednesday, September 30, 2009

Tuesday, September 29, 2009

Developing a financing map

There is a clear destination, and the prize for reaching it is intoxicating - the fabled Initial Public Offering (IPO) or the successful trade sale of the company that turns the founders & investors into latter-day robber barons. There is a generic five-to-seven-year map that has been established by prior generations of entrepreneurs regarding how to build a business.

But this is new terrain. Every new business that has world-beating aspirations is unique. There are lots of issues. What competitors are out there lurking in the tall grass? If a competitor or some other roadblock thwarts the company, is there a way round? Are there small steps that the company might take up front to block competitors? Is the destination as clear as it seems at first glance? Or are there multiple possible destinations - might some of them be even more interesting than the most obvious destination?

Take the example of Creditica. Clearly, it is a modest creation today. At its simplest, it is a 20-page slide presentation containing insightful perspectives on the opportunity, put together by some smart mathematcians. It is plausible to look forward five to seven or more years and to see it as a good-sized company capable of undertaking an IPO. The situation is pregnant with possibilities. But it is dizzying to think of everything that needs to be done on the journey from here to there. What should be done first? Who should be hired and when? Which customers should be approached first? What happens if competitors get to the market first? How is Creditica going to be financed?

Communicating the complexity of all these execution issues to investors, while still conveying the sense of opportunity, is very difficult.

An early stage venture should simplify its business plan by breaking the planned development of the company into 3 or 4 major stepping stones on the way to the prize. These stepping stones should become the financing blueprint for the business. This concept of building a valuable business through multiple staging posts, each of which is financed separately, is the core tenet underpinning entrepreneurial finance. All the complexities and incongruities on the way are derived from this one concept.

The best place to start is to show how the 5 to 10 year plan for a business can and should be split into a series of major stepping stones, normally 3 to 4.

But this is new terrain. Every new business that has world-beating aspirations is unique. There are lots of issues. What competitors are out there lurking in the tall grass? If a competitor or some other roadblock thwarts the company, is there a way round? Are there small steps that the company might take up front to block competitors? Is the destination as clear as it seems at first glance? Or are there multiple possible destinations - might some of them be even more interesting than the most obvious destination?

Take the example of Creditica. Clearly, it is a modest creation today. At its simplest, it is a 20-page slide presentation containing insightful perspectives on the opportunity, put together by some smart mathematcians. It is plausible to look forward five to seven or more years and to see it as a good-sized company capable of undertaking an IPO. The situation is pregnant with possibilities. But it is dizzying to think of everything that needs to be done on the journey from here to there. What should be done first? Who should be hired and when? Which customers should be approached first? What happens if competitors get to the market first? How is Creditica going to be financed?

Communicating the complexity of all these execution issues to investors, while still conveying the sense of opportunity, is very difficult.

An early stage venture should simplify its business plan by breaking the planned development of the company into 3 or 4 major stepping stones on the way to the prize. These stepping stones should become the financing blueprint for the business. This concept of building a valuable business through multiple staging posts, each of which is financed separately, is the core tenet underpinning entrepreneurial finance. All the complexities and incongruities on the way are derived from this one concept.

The best place to start is to show how the 5 to 10 year plan for a business can and should be split into a series of major stepping stones, normally 3 to 4.

Friday, September 25, 2009

VCing startups

Thursday, September 24, 2009

Regional VC organizations in the United States

Apart from the National Venture Capital Association (NVCA) there are many regional Venture Capital organizations in the United States which are mentioned below:

- The Atlanta Venture Forum

- Dallas/Ft. Worth Private Equity Forum

- The Collaborative

- Connecticut Venture Group

- Council for Entrepreneurial Development

- Evergreen Venture Capital Association

- Florida Venture Forum

- Illinois Venture Capital Association

- Los Angeles Venture Association

- Long Island Capital Alliance

- Michigan Venture Capital Association

- Mid-Atlantic Capital Alliance (MAC)

- The Mid-Atlantic Venture Association (MAVA)

- Mid-America Healthcare Investor Network (MHIN)

- Minnesota Venture Capital Association (MVCA)

- The New England Venture Capital Association (NEVCA)

- New Jersey Tech Council

- New Mexico Venture Association

- OCTANe

- Orange County Venture Group

- Pittsburgh Venture Capital Association

- Rocky Mountain Venture Capital Association

- Venture Investors Association of New York

- San Diego Venture Group

- Texas Venture Capital Association

- Upstate Venture Association of New York (UVANY)

- Venture Club of Indiana

- Venture Club of Louisville

- The Western Association of Venture Capitalists (WAVC)

Tuesday, September 22, 2009

Monday, September 21, 2009

Raising Venture Capital for the Serious Entrepreneur

Raising Venture Capital for the Serious Entrepreneur is a book by Dermot Berkery which helps you in understanding the basics of the venture capital method, raising the finance, valuing the early stage venture and negotiating the deal with term sheets with topics such as Developing a financing map, Getting to the first stepping stone, The Unique Cash Flow & Risk Dynamics of early stage ventures, Determine the amount of capital to raise & what to spend it on, Getting behind how VC firms think, creating a winning business plan, valuing early stage companies, agreeing on a term sheet with a VC, terms for splitting the rewards, allocating control between founders/management & investors and aligning the interests of founders/management & investors.

Raising Venture Capital for the Serious Entrepreneur is a book by Dermot Berkery which helps you in understanding the basics of the venture capital method, raising the finance, valuing the early stage venture and negotiating the deal with term sheets with topics such as Developing a financing map, Getting to the first stepping stone, The Unique Cash Flow & Risk Dynamics of early stage ventures, Determine the amount of capital to raise & what to spend it on, Getting behind how VC firms think, creating a winning business plan, valuing early stage companies, agreeing on a term sheet with a VC, terms for splitting the rewards, allocating control between founders/management & investors and aligning the interests of founders/management & investors.The book also attempts to answer questions like Why new ventures are not fully funded from the START and also has term sheet exercises to draft a best one for your venture.

Thursday, September 17, 2009

Another cartoon for a Venture Capital

Wednesday, September 16, 2009

Legal documents for a Venture Capital

Some of the legal docments required in a VC are:

- Term Sheet

- Stock Purchase Agreement

- Certificate Of Incorporation

- Investor Rights Agreement

- Voting Agreement

- Right of First Refusal & Co-Sale Agreement

- Management Rights Letter

- Indemnification Agreement

- reflect and in a number of instances, guide and establish industry norms

- be fair, avoid bias toward the VC or the company/entrepreneur

- present a range of potential options, reflecting a variety of financing terms

- include explanatory commentary where necessary or helpful

- anticipate and eliminate traps for the unwary (e.g., unenforceable or unworkable provisions)

- provide a comprehensive set of internally consistent financing documents

- promote consistency among transactions

- reduce transaction costs and time

Tuesday, September 15, 2009

Mistaken for capital

Monday, September 14, 2009

Some Venture Capital facts

Find below some interesting Venture Capital facts particularly about the USA:

- Top ten states for venture capital investing in 2008 were: CA, MA, NY, TX, WA, CO, NJ, PA, MN, VA.

- Venture capitalists typically invest and actively engage in their portfolio companies for 5 – 7 years, often longer and rarely less.

- The Clean Technology industry is the fastest growing sector of venture investment, growing 54 percent in the last year alone.

- 1 in every 3 Americans is positively impacted by a venture backed medical innovation.

- There are fewer than 700 venture capital firms in the United States.

- 1 in every 4 venture backed public companies was founded by a foreign born national.

- In 2008, corporate venture capital arms were investors in 19.2 percent of all venture deals.

- Venture-backed companies account for 10.4 million U.S. jobs and 18 percent of U.S. GDP.

- Since 1970, venture capitalists have invested $466 billion into more than 60,700 companies.

Thursday, September 10, 2009

(Re)inventing the wheel

Wednesday, September 9, 2009

Venture Capital & popular culture

Find below some notable incidents in history on the popular culture about Venture Capital:

- Robert von Goeben & Kathryn Siegler produced a comic strip called 'The VC' between the years 1997 & 2000 that parodied the VC industry, often by showing humorous exchanges between VCs & entrepreneurs. Von Goeben was a partner in Redleaf Venture Management when he began writing for the comic strip.

- Mark Coggins' 2002 novel 'Vulture Capital' features a venture capitalist protagonist who investigates the disappearance of the chief scientist in a biotech firm in which he has invested. Coggins also worked in the industry & was the co-founder of a dot-com startup.

- In the Dilbert comic strip, a character named 'Vijay, the World's Most Desperate Venture Capitalist' frequently makes appearances, offering bags of cash to anyone with even a hint of potential. In one strip, he offers two small children with good math grades money based on the fact that if they marry and produce an engineer baby he can invest in the infant's first idea. The children respond that they are already looking for mezzanine funding.

- Drawing on his experience as reporter covering technology for the New York Times, Matt Richtel produced the 2007 novel Hooked, in which the actions of the main character's deceased girlfriend, a Silicon Valley venture capitalist, play a key role in the plot.

- In the TV series Dragons' Den, various startup companies pitch their business plans to a panel of venture capitalists.

Tuesday, September 8, 2009

Monday, September 7, 2009

Sand Hill Road: Address to many VCs

Sand Hill Road is a popular place in Menlo Park, California, where one can locate many Bay Area VC firms. Sand Hill Road is referred to Private Equity in the US in the same way as Wall Street is referred to the stock market. Sand Hill Road connects El Camino Real & Interstate 280 and an provides easy access to the Stanford University & the Silicon Valley.

Sand Hill Road is a popular place in Menlo Park, California, where one can locate many Bay Area VC firms. Sand Hill Road is referred to Private Equity in the US in the same way as Wall Street is referred to the stock market. Sand Hill Road connects El Camino Real & Interstate 280 and an provides easy access to the Stanford University & the Silicon Valley.Some of the top VCs on the Sand Hill Road are:

- Accel-KKR

- Azure Capital Partners

- Battery Ventures

- Benchmark Capital

- Draper Fisher Jurvetson

- Highland Capital Partners

- Kleiner, Perkins, Caufield & Byers

- Kohlberg Kravis Roberts

- Matrix Partners

- New Enterprise Associates

- Sequoia Capital

- Shasta Ventures

- Silver Lake Partners

- Storm Ventures

- The Blackstone Group

- TPG Capital, L.P.

- U.S. Venture Partners

Saturday, September 5, 2009

What Is Venture Capital?

Entrepreneur.com describes a VC as the following:

What It Is: Institutional venture capital comes from professionally managed funds that have $25 million to $1 billion to invest in emerging growth companies.

Appropriate for: High-growth companies that are capable of reaching at least $25 million in sales in five years.

Best Use: Varied. From financing product development to expansion of a proven and profitable product or service.

Cost and Funds Typically Available: Expensive. Institutional venture capitalists demand significant equity in a business. The earlier the investment stage, the more equity is required to convince an institutional venture capitalist to invest. The range of funds typically available is $500,000 to $10 million.

Ease of Acquisition: Difficult. Institutional venture capitalists are choosy. Compounding the degree of difficulty is the fact that institutional venture capital is an appropriate source of funding for a limited number of companies.

What It Is: Institutional venture capital comes from professionally managed funds that have $25 million to $1 billion to invest in emerging growth companies.

Appropriate for: High-growth companies that are capable of reaching at least $25 million in sales in five years.

Best Use: Varied. From financing product development to expansion of a proven and profitable product or service.

Cost and Funds Typically Available: Expensive. Institutional venture capitalists demand significant equity in a business. The earlier the investment stage, the more equity is required to convince an institutional venture capitalist to invest. The range of funds typically available is $500,000 to $10 million.

Ease of Acquisition: Difficult. Institutional venture capitalists are choosy. Compounding the degree of difficulty is the fact that institutional venture capital is an appropriate source of funding for a limited number of companies.

Friday, September 4, 2009

Venture Capital investments in Google

The first funding for Google as a company was secured in August 1998, in the form of a $100,000 contribution from Andy Bechtolsheim, co-founder of Sun Microsystems, given to a corporation which did not yet exist.

The first funding for Google as a company was secured in August 1998, in the form of a $100,000 contribution from Andy Bechtolsheim, co-founder of Sun Microsystems, given to a corporation which did not yet exist.On June 7, 1999 a round of funding of $25 million was announced, with the major investors being rival venture capital firms Kleiner Perkins Caufield & Byers and Sequoia Capital.

The Google IPO took place on 19 August 2004. 19,605,052 shares were offered at a price of $85 per share. Of that, 14,142,135 (another mathematical reference as √2 ≈ 1.4142135) were floated by Google, and the remaining 5,462,917 were offered by existing stockholders. The sale of $1.67 billion gave Google a market capitalization of more than $23 billion. The vast majority of the 271 million shares remained under the control of Google. Many Google employees became instant paper millionaires. Yahoo!, a competitor of Google, also benefited from the IPO because it owned 8.4 million shares of Google as of 9 August 2004, ten days before the IPO.

The stock performance of Google after its first IPO launch has gone well, with shares hitting $700 for the first time on 31 October 2007, due to strong sales and earnings in the advertising market, as well as the release of new features such as the desktop search function and its iGoogle personalized home page. The surge in stock price is fueled primarily by individual investors, as opposed to large institutional investors and mutual funds.

The company is listed on the NASDAQ stock exchange under the ticker symbol GOOG and under the London Stock Exchange under the ticker symbol GGEA.

Wednesday, September 2, 2009

Twitter - The 100% VC online business

With Twitter making waves all across the internet, it's interesting to note that with not any revenue income, the company has raised millions of dollars from venture capitalists. The exact amounts of funding have not been made public yet but the total stands at around US$ 57 million under different rounds and the highest being $35 million from Institutional Venture Partners and Benchmark Capital. Some VCs who have invested money in Twitter are Benchmark Capital, Bezos Expeditions, Digital Garage, Institutional Venture Partners, Spark Capital & Union Square Ventures.

With Twitter making waves all across the internet, it's interesting to note that with not any revenue income, the company has raised millions of dollars from venture capitalists. The exact amounts of funding have not been made public yet but the total stands at around US$ 57 million under different rounds and the highest being $35 million from Institutional Venture Partners and Benchmark Capital. Some VCs who have invested money in Twitter are Benchmark Capital, Bezos Expeditions, Digital Garage, Institutional Venture Partners, Spark Capital & Union Square Ventures.

Tuesday, September 1, 2009

Top Venture Capitalists

Some of top Venture Capitalists of the world are:

- Atlas Venture

- Azione Capital

- Bain Capital Ventures

- Benchmark Capital

- Bessemer Venture Partners

- Canaan Partners

- Charles River Ventures

- Clearstone Venture Partners

- Draper Fisher Jurvetson

- Enterprise Partners

- Fidelity Ventures

- Highland Capital Partners

- Insight Venture Partners

- Kleiner, Perkins, Caufield & Byers

- Mayfield Fund

- New Enterprise Associates

- Oak Investment Partners

- Point Judith Capital

- Quicksilver Ventures

- Scottish Equity Partners

- Sequoia Capital

- Sevin Rosen Funds

- Sigma Partners

- Tenaya Capital

- Union Square Ventures

- Viking Venture

- Wellington Partners Venture Capital

Monday, August 31, 2009

Venture Capitals

Venture Capital, also called VC, Venture or Angel Investing, is the capital which is provided by investors to high potential, largely new age, companies. Basically it's type of a private equity capital which is invested by Venture Capitalists to early stage companies in the interest of generating high returns out of the investment. Most of the investments are made in cash in exchange for shares in the invested company.

This blog is your gateway towards finding Venture Capitals from all across the world at a single place. We will also keep you updated of the latest movements in the VC industry together with the proposals, documents, etc. that you may need for a VC for your venture.

Good luck!!!

This blog is your gateway towards finding Venture Capitals from all across the world at a single place. We will also keep you updated of the latest movements in the VC industry together with the proposals, documents, etc. that you may need for a VC for your venture.

Good luck!!!

Subscribe to:

Comments (Atom)